bear trap stock term

The predicament facing short sellers when a bear market reverses its trend and becomes bullish. This phenomenon and market performance lure many traders in investing and buying in the market.

What Is A Bear Trap On The Stock Market

Bear traps spring as brokers initiate margin calls against investors.

/Clipboard01-c2c4a2d12c05468184b82358f12a1af5.jpg)

. A bear trap is the opposite of a bull trap. What is Bear Trap in the Stock Market. The stock markets bounce back from the brink of a bear market has set up the potential for a.

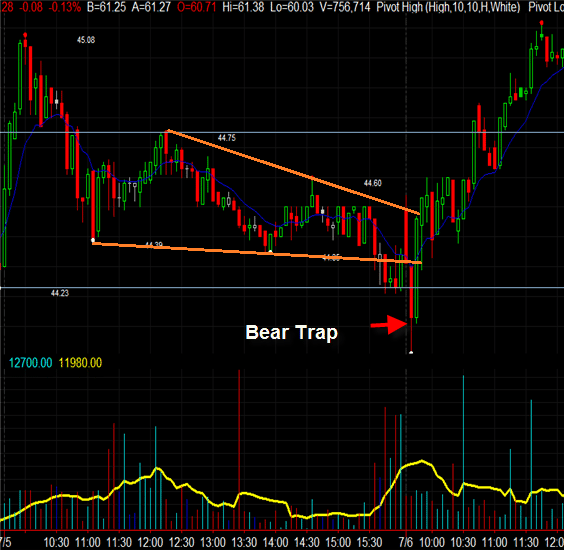

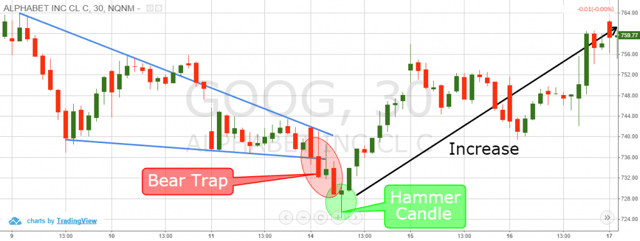

It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward trend. A bear trap stock is a downward share price that lures investors to sell short Centralized Market Definition. The creation of a bear trap involves the careful planning and execution of a set of circumstances in which there is sense of an impending short term fall in the price of a given security that will be followed by a long term upswing in the price.

In general a bear trap is a technical trading pattern. Use a different trading strategy. Heres a closer look at bear trap trading.

A bear trap denotes a technical pattern that occurs when the performance of a stock index or other financial instrument incorrectly signals a reversal of a rising price trend. Lets get started today. Bear traps typically follow bullish patterns.

Bear Trap Stock is a term used in the stock market to describe a particular type of investment. Its an advanced trading strategy and isnt appropriate for most investors. March 22 2022 300 AM PDT.

What is a Bear Trap. Ad Were all about helping you get more from your money. The Nasdaq Composite Index boomeranged 10 last week from its March.

What is Bear Trap. There are many ways to lose money in down markets and buying fleeting rebounds is among the best. A bear trap is best-defined as a false reversal at the culmination of a pattern.

A false signal which indicates that the rising trend of a stock or index has reversed when in fact i. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively. Answer 1 of 4.

A Bear Trap occurs when a stock that has been declining suddenly reverses and starts to rise. It is a false indication of a reversal from an uptrend into a downtrend. Dont take a short position.

Bear trap trading is the unanticipated behavior of a stock that lures bearish investors into false positions that can hurt your portfolio. Most traders commonly dont know how to trade bear traps or when theyre. Overview and Examples What Is a Centralized Market.

While not an indicator a bear trap is a technical trend or pattern that can be seen when the price movement of a stock or any financial security signals a false reversal from a downward to an upward trend. The simplest way to avoid getting caught in a bear trap is to avoid taking short positions altogether. Essentially the bear trap is designed to encourage investors to buy at a higher price with the anticipation that during the.

Rising stock prices cause losses for bearish investors who are now trapped Typically betting against a stock requires short-selling margin trading or derivatives. When this happens anyone who was betting on the stock to go down ends up losing money even if the stocks increase is only temporary. A bull trap denotes the opposite of this phenomenon.

When prices in an uptrend abruptly drop a bear trap follows. Selling a stock short is highly speculative and high-risk. An accumulation of shares being sold short by bears trying to drive down the price of a stock.

A bear trap is a condition in the market where the expected downward movement of prices suddenly reverses up. A centralized market is a system where orders are routed to a clearinghouse and buyers and sellers transact with the. As the name itself suggests a bear trap is basically a situation when forex traders think that a support level is breaking and so as soon as price moves below the support level they start selling due to the supposed breakout.

A bull trap is a false signal referring to a declining trend in a stock index or other security that reverses after a convincing rally and breaks a. What is a Bear Trap. In the stock market traders depend on technical indicators to help them trade effectively.

Many investors who have been watching the stock decline will sell it at this point because they believe that the trend has reversed and the stock will continue to go down. The bear trap occurs when the bears find they must repurchase the shares from an individual or a group at an artificial price determined by the seller. A bear trap or bear trap pattern is a sudden downward price movement luring bearish investors to sell an investment short followed by a price reversal back upward.

Bear traps occur when investors bet on a stocks price to fall but it rises instead. Stocks poised for near-term rally after SP 500 flirts with bear market but selling is not over. If youre thinking about short-selling or have done any research you might have heard the term bear trap This is what happens when a stock or other security stops dropping and unexpectedly begins rising.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. This causes traders to open short positions with expectations of profiting from the assets price decline. Whether youre a pattern trader or just have a hunch about the trajectory of a stock price its important to understand what a bear trap is as well as how to identify and avoid one.

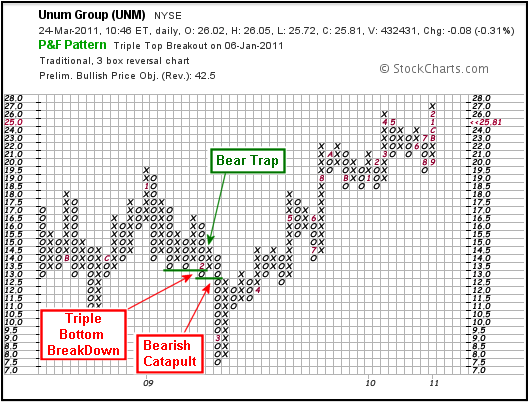

P F Bull Bear Traps Chartschool

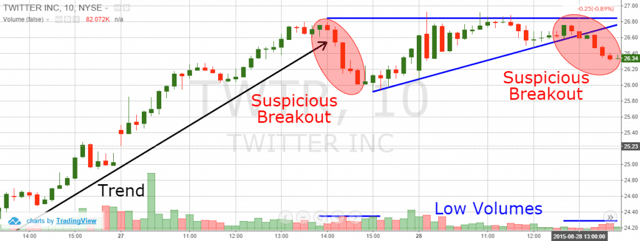

What Is A Bear Trap On The Stock Market Fx Leaders

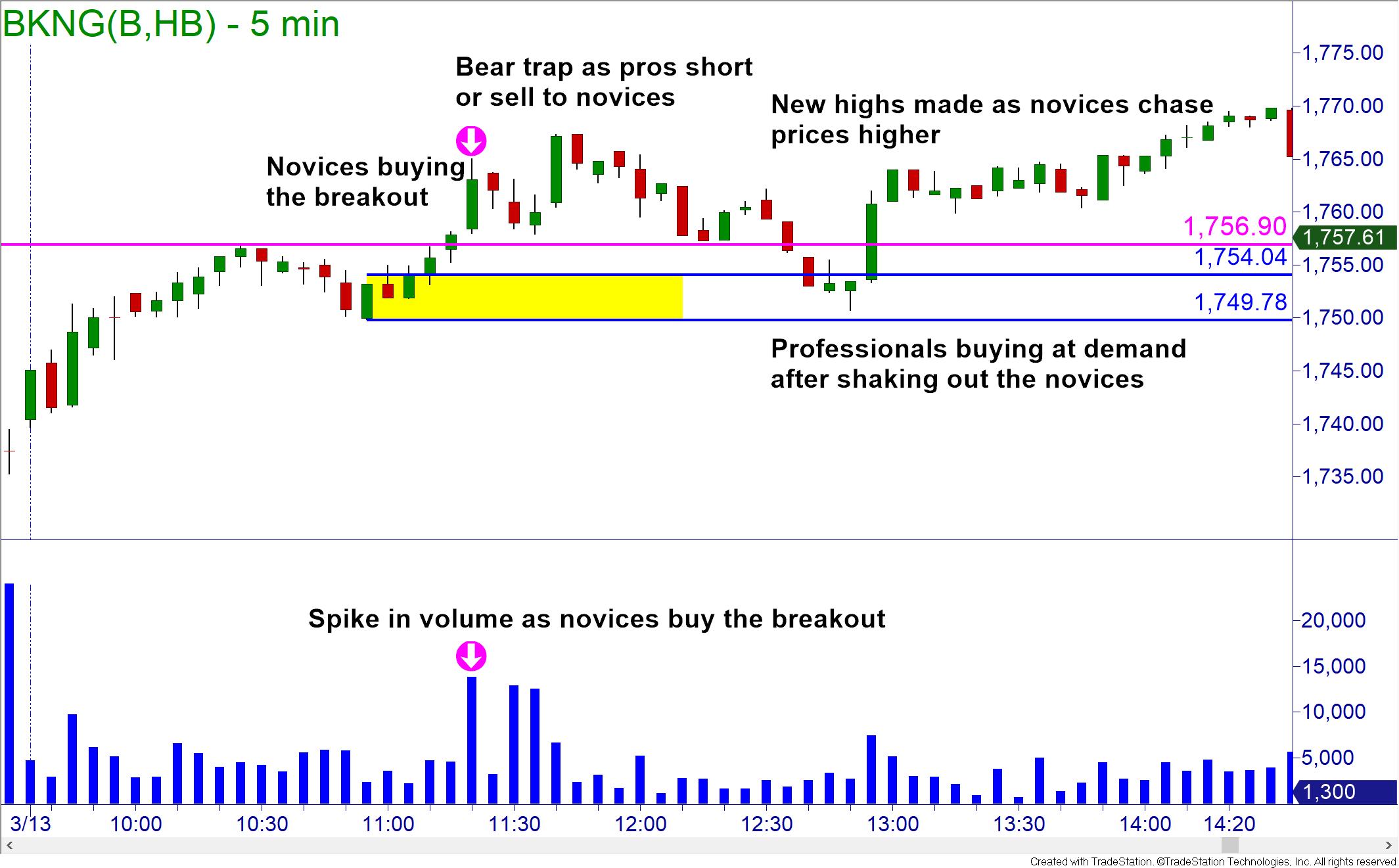

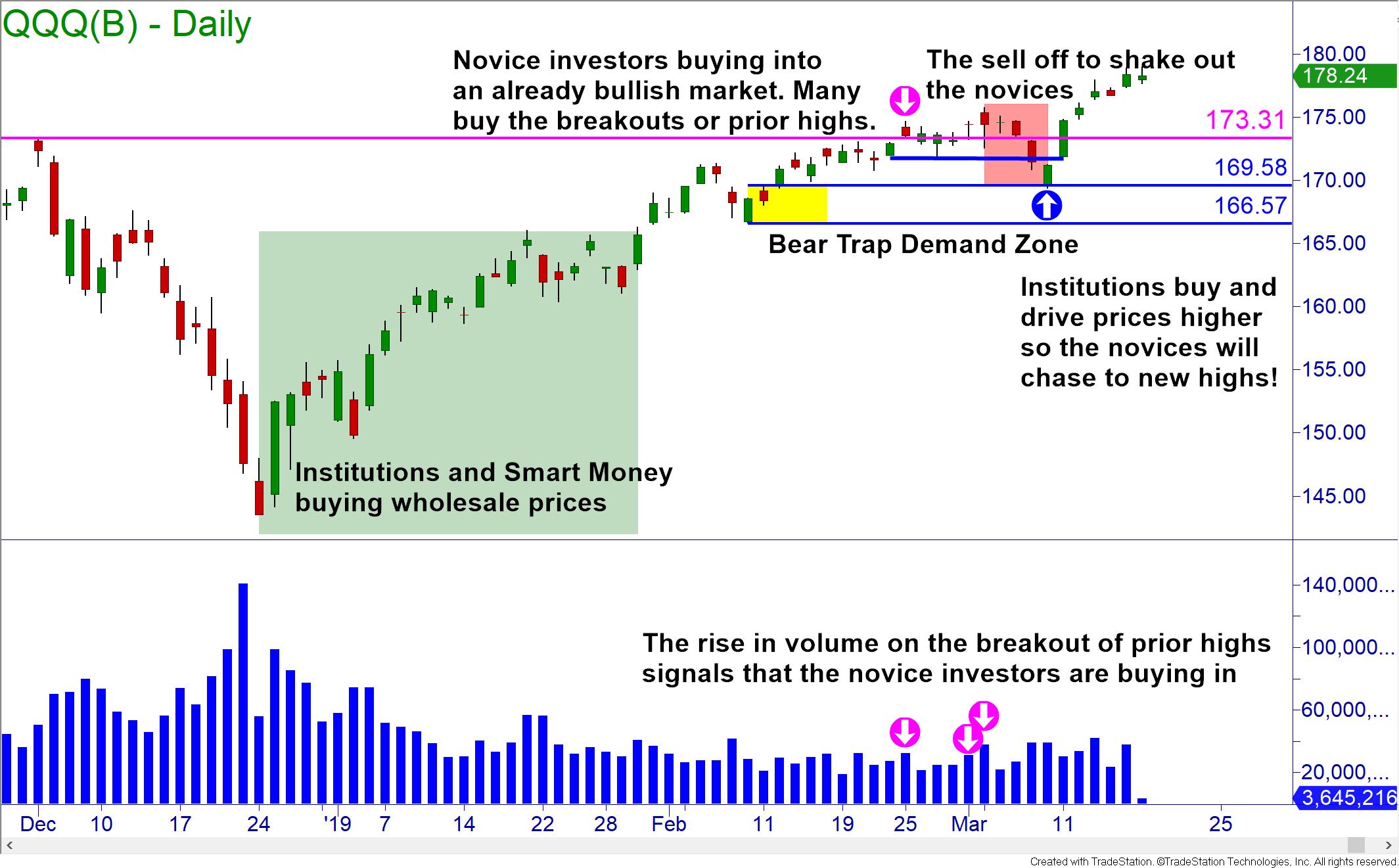

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

What Is A Bear Trap On The Stock Market

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape

Bear Trap Stock Trading Definition Example How It Works

What Is A Bear Trap Seeking Alpha

Bear Trap Explained For Beginners Warrior Trading

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bull Trap In Trading And How To Avoid It Ig En

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim